Archive

$Rich AXP Broke And Then Flatlined….

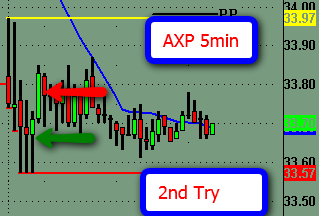

Took the break down this morning and it went no where for 4 hours!!! Due to the market doing nothing all day. Booked Small profit.

Then took it again thinking it would break the .50 level..no luck

ehh today was a boring day with nothing to do but sit on your hands and be disciplined.

Took small loss for the day…not trading anymore today till the market picks up some steam..aka the vix moves out of its .10 range!

$Deb Says: Why and how should traders condition the mind?

The best analogy that I can find for this topic can be found in the sports world. Professional athletes do a tremendous amount of physical conditioning and mental conditioning in their training to become and be the best at their game. Traders, much like the professional athlete, must work toward conditioning themselves to become the best trader possible. This post will focus on mental conditioning as opposed to the physical for the obvious reason that much of the trading “game” is mental.

I have found that once I developed a system of mental conditioning for myself that my trading improved exponentially in a very short period of time. The following describes what I do as a trader in my “batting practice” which is intensely focused on my mental conditioning.

I started with the following sentence that I tell myself at the start, middle, and end of each day and anytime in between when I need to hear it. That sentence is:

“I am a professional trader sound and act like one”.

Following that everything that I think, do, and don’t do must stem from and depend on that one statement. By using this statement I am constantly affirming what I believe about myself, what I expect from myself, and what I need to do based on that belief and expectation.

Next, each day and each week I study my trader report and although I look at all components of the report, I focus heavily on the following:

- Stocks traded & which stocks I was net profitable in and which stocks I lost money on.

- How many trades I traded actively and passively.

- Trader performance. Specifically I spend a considerable amount of time following my “BAT” and “W/L” columns.

Notice that P/L is not mentioned. I do not focus on P/L; rather, I look at it daily just to know where I am so that I can put it into my money/risk management plan for the week, day, or moment.

Last, every Sunday I have a meeting with myself for actual “batting practice”. This includes the following.

- I analyze at least 2/3 good trades and 2/3 poor trades.

- I go through the actual aforementioned trades identified using the tick replay function on the trading platform.

- I act as if I were trading it all over again and I use the stop loss parameters that I have so I can identify what would happen if I increased risk or decreased risk. This allows me to see where I would be stopped out, what loss I would take on that particular trade, and how many like it I could take before I reached my daily stop loss. This has helped me to be able to take the risk so that on good trades I can hold on longer and on bad trades I can cut them fast. And, if I do happen to take a big hit, it is not traumatizing rather, I conditioned myself to accept it and move on.

- I use the tick replay as well in my planning of future trade scenarios. If you know what happened before in price action then planning for future price action is a natural next step.

This mental conditioning has been essential in my development as a trader and I believe that without it I would not have made the progress that I have made. In short, building mental stamina to intensely analyze yourself and your actions as a trader, practice over and over again, and get your mind to feel comfortable with the risk that one must take to make gains is a must to being a successful, professional trader.

$Deb Says: When is “the” time to really be ticked at yourself as a trader?

Trading is something that takes a lot of time, patience, and skill development. Professional trading is not an art or a skill; but an art and a skill rolled into one.

That being said, it is very easy to really beat oneself up along the way which is counterproductive to what is psychologically necessary to enter into, progress, and continue to develop and master new, higher levels in the learning process.

Hence, there will be many occasions when a trader will make mistakes. It is a natural part of learning. As long as mistakes are used to learn from then mistakes are the “tool” needed to promote learning.

The following question comes to mind: Is there a time when one really needs to be ticked off at herself? I say yes as I recently experienced one of those moments.

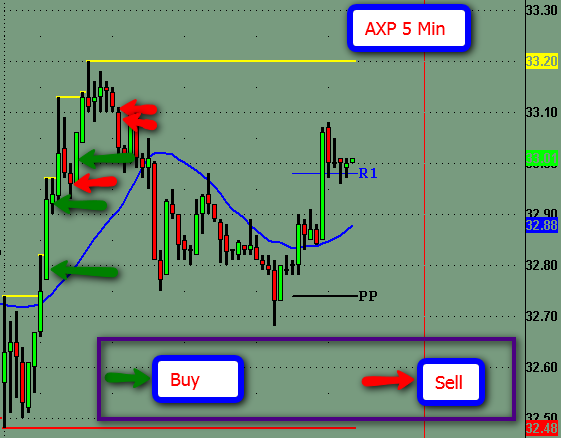

Yesterday AXP opened strong, broke down with the market, reversed, and then rallied/trended all day despite the market being stuck in the days range and the previous day’s range for a majority of the day. I put on a position at a significant breakout level and waited for follow through. It “played” around but I believed in the trade so I held it. It moved in my favor and reached the next whole number that I was watching for.

When it hit the whole number and blew through it, I followed my plan to book half the position and hold the rest with a stop at +1 making the trade a free trade at that point. I did this because I felt the need to protect gains as the market was not yet confirming an upside move. AXP was moving with its own wind behind its back.

My original profit target was approximately .50 or so cents away. AXP made another move and stalled so I decided on the spot to book the profit I had despite the fact that I was holding a free trade. Remember the worst that could have happened was I would get stopped out at +1.

After I booked profit and was no longer dancing with AXP, the SPY took off, broke to new highs, and did so for a portion of the afternoon and AXP blew through my original profit target by .20 cents or so.

Why should I be mad at myself in this situation?

I am mad at myself and should be because I had the perfect entry (that was never seen again in the day) and a stop loss that gave me, at worst, a free trade. I had NOTHING to lose. One must keep the profit target in mind and be completely in tune with the price action in front of oneself as one never knows when a simple free trade will become the trade of the day.

Deb Says:Why are expectations so important?

This post starts out with a quote that I think is extremely important to all traders . That quote is:

” If market behavior does not conform to expectations, get out”…Schwager

If you think about it, as traders all of our trading decisions and actions stem from our expectations regarding price action and sentiment in the market and in individual stocks.

Hence, its really simple and short when the market’s behavior does not do what you expect it to do then just get out. Meaning, do not hope!! Hope is deadly to traders.

$Rich I Paid My Amex Bill And The Stock Ran To The HOD

Today was a fun morning…Traded AXP and rang the register…Then played around with it and chopped around lost a little but still made out from my morning trade.

Could have played the trade better. There is always next time…

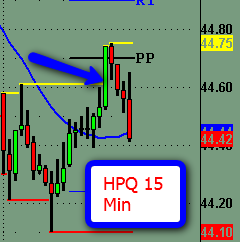

Oh And the Fake Out Award Of The Month Goes To: HPQ

Which didn’t get me today!

Congrats HPQ!!

Recent Comments