Archive

$Debbie: Looking Forward To November

As a developing trader, it is important for me to look forward and have an updated list of things I need to keep in mind.

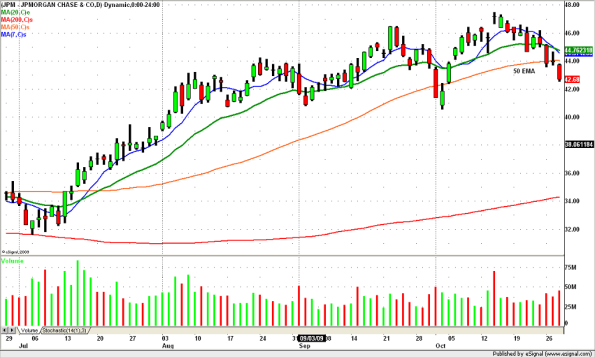

1. I will focus most on my “pet” stock JPM unless it becomes untradable (signified by really ugly unreadable charts in multiple time frames).

$Debbie: What do I do when the pressure is on?

This was Debbie’s situation at the end of October.

Two days left in the month, down by a little bit net and being net flat on month was in sight which had become my new weekly goal for ending October. Debbie’s psychology was strong and ready for the challenge.

One day left in month, down by a bigger number net and being net flat, with only one day left in the month, net flat on the month slid into the distance and was still in sight but very fuzzy. Debbie’s psychology was weakened and sprinkled with grains of defeat. Ended day with big headache.

The last day of the month, entered day with an “I will make money today when opportunity presents itself’ attitude. Ended up on day by best number yet, and down by very little net and being basically alomost flat on month. I allowed myself to consider my goal of being flat on month achieved. Ended day with big headache.

What did I do when the pressure was on?

1. I allowed myself to be angry and pout the night before the last day of month but by the end of night I made sure to shift my attitude from a pouty, negative one to a conquering, positive one. I had a headache due to the let down and stress.

2. I came into the last day of the month viewing it as a new day, one in which I would make money, and one in which when opportunity presented itself I would capitalize on it. I told myself “you know this, you can do this, you will do this”….be alert, be focused, pay attention, and the market will present something…you just have to see it”. I ended the day with a headache due to intense focus on what I was doing.

3. The biggest thing……I did not give up and I did not just accept that my month was going to be a negative one. And more importantly, when I got to just barely flat on the month I booked the profit and took a position on sidelines and watched. I did not say that I had to get a few more cents to wipe out the measly , small net negative number. I looked at the market, time of day, charts in front of me, and determined that it was just was not worth risking anything else. Afterall it was also the last day of the month.I allowed myself to consider my goal of net flat on month achieved. This is important to my psychology and confidence.

Profitable Trading All!!

Debbie

$Debbie: End of Month Reflections

End of day recap October 27th

Sell Sell Sell $

How quickly things change in the world of trading! We have now sold off for 4 consecutive days on above average volume. Just a week and a half ago, it seemed like we would never have a down day again. Psychologically the SPY hit 110 and bounced off it like a brick wall. The US dollar has been trending up while gold is on the defense. GLD broke below the 20 ema yesterday and continues to retrace back towards the 50 EMA. The financial sector which has been Wall Street’s sweet heart since the lows in March was one of the weakest sectors today. Whether this is a turning point in the markets or just another pull back to get long remains to be seen. But one thing is for sure, it is healthy. The markets needed to take a breathe. If history has shown us anything, Greed is not good! Innocent people end up getting hurt!

With the SPY breaking below the 50 EMA today for the first time since July 15th, we need to be cautious with any longs, as there does not seem to be any support until $102.68. After 4 straight days of selling, we see some nibbling on the long side with a possible test at $107.

As always, you want to have scenarios (STOCKS) for both sides of the market.

Recent Comments